New Mortgage Rules – Renewing and Refinancing January 1st, 2018 Canada’s new mortgage rules came into effect and it was big news. These new rules appear to have the greatest impact on those looking to qualify for a new mortgage but if you are looking to renew or refinance your mortgage, you may be impacted as well. At the centre of the new rules is a stress test requiring applicants to qualify at a rate at least 2% higher than the rate they will be paying, regardless of the down payment they are making on the home. The new rules

Read More

Archives for Ottawa real estate

Ottawa Real Estate Market Update : Low Inventory Continues Into 2018

The Ottawa Real Estate board’s recently released statistics show that home buyers are still actively searching for properties. Sales were up over 7% (year over year) in spite of the low inventory, which is a trend that is continuing from 2017. January 2018 listings 994 (RES) and 406 (CONDO) compared with the 5 year 1,396 for residential and 500 for condominiums. If the decrease in supply in both the residential and condo markets continues into the Spring, it may put an upward pressure on prices. If you are thinking of selling this is a great time to get your home on the market.

Read More

An Era of Change: 2018

An Era of Change: 2018 Canadian real estate is in an era of change. 2017 closed with a bang, as we saw some of the largest increases in real estate prices in nearly a decade. The curiosity now turns to 2018, and what can we expect to see in Ottawa, and across Canada. Ottawa is climbing the list as a hot spot for home buyers this year, joining popular cities like Toronto, Montreal and Vancouver. Ottawa may hold an even higher interest for buyers, where real estate prices are significantly lower than areas such as Toronto and Vancouver. The pool of potential home

Read More

A Strong Finish for Ottawa’s Real Estate Market in 2017

2017 was quite a year in the Ottawa Real Estate market; record breaking numbers in units sold (condominium sales up over 22%) and double digit (percentage) increases in average sale price in several neighbourhoods, Canada 150 (or should we say Ottawa 150?!) was anything but average! Below we’ve included the latest news release from the Ottawa Real Estate Board. Please note: average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of

Read More

Ottawa Real Estate Latest Market Snapshot

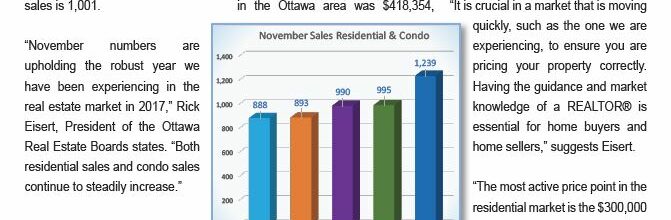

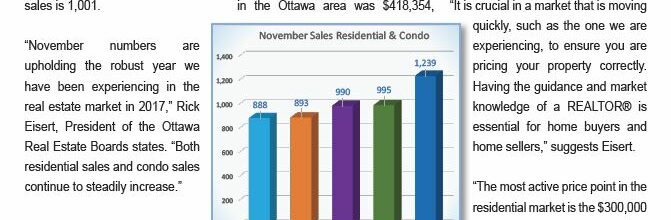

It’s hard to believe November is over but here we are! If you’ve been following Ottawa real estate you’ll know it’s been a busy 2017 and December will likely be no exception. With the new mortgage rules coming into play in a few short weeks, many buyers are motivated to have firm deals completed before January 1st, 2017. We’ve included the latest news release from the Ottawa Real Estate Board below. Please note: average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value.

Read More

Ottawa Real Estate Latest Market Snapshot

It’s hard to believe November is over but here we are! If you’ve been following Ottawa real estate you’ll know it’s been a busy 2017 and December will likely be no exception. With the new mortgage rules coming into play in a few short weeks, many buyers are motivated to have firm deals completed before January 1st, 2017. We’ve included the latest news release from the Ottawa Real Estate Board below. Please note: average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value.

Read More

What Canadian home buyers need to know NOW about the upcoming changes to Mortgage rules

Confused by the upcoming changes to the mortgage rules? Don’t panic. Our very own Kent Browne, Owner and Broker at Royal LePage Team Realty, sat down with Mortgage Broker York Polk of Mortgage Alliance to discuss all these changes in order to help you, our clients, understand how they may affect you. What home buyers need to know before 2018 As of January 1, 2018, Canadian homebuyers will have to meet stiffer requirements in order to qualify for a mortgage with a federally regulated mortgage lender. Why are the Mortgage Rules changing? As Canada’s financial “watchdog” OSFI believes these new

Read More